[kc_row _id=”413226″][kc_column _id=”206093″][kc_column_text _id=”600759″ css_custom=”{`kc-css`:{}}”]

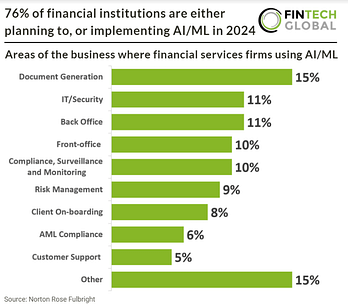

In the ever-evolving landscape of finance, technology continues to revolutionize the way institutions operate. One of the most prominent advancements in recent years is the integration of Artificial Intelligence (AI) and Machine Learning (ML) into financial services. A recent survey conducted by Norton Rose Fulbright sheds light on this phenomenon, revealing that in 2024, a staggering 76% of financial institutions are either envisioning or actively utilizing AI/ML solutions.

The Current Landscape:

The survey paints a picture of a sector on the brink of significant transformation. With 76% of respondents either already incorporating AI/ML or contemplating its implementation, it's evident that the industry recognizes the potential benefits of these technologies. From enhancing operational efficiency to driving cost savings and improving services, AI/ML holds the promise of revolutionizing traditional financial practices.

Anticipated Growth:

Looking ahead, the momentum behind AI/ML adoption shows no signs of slowing down. A striking 94% of financial services firms anticipate increased utilization of AI/ML over the next three years. This forecast underscores the industry's recognition of the transformative power of these technologies and highlights a growing commitment to integrating them further into business operations.

Challenges and Considerations:

Despite the undeniable advantages, the integration of AI/ML into financial institutions is not without its challenges. Concerns such as corporate data leakage, regulatory compliance, and the need for comprehensive usage policies and staff training loom large. Additionally, data limitations, regulatory barriers, and a shortage of expertise pose significant obstacles to widespread adoption.

Navigating Obstacles:

To address these challenges effectively, financial institutions must adopt a proactive approach. Engaging with regulators, ensuring compliance with existing regulations, and prioritizing data security are paramount. Moreover, fostering a culture of continuous learning and development can help bridge the skills gap and empower employees to leverage AI/ML technologies effectively.

Model Development and Resourcing:

When it comes to AI/ML model development, financial institutions predominantly rely on in-house resources, often supplemented by third-party assistance. However, the effectiveness of ML models hinges on access to quality training data, which remains a challenge for many organizations. Consequently, addressing data limitations emerges as a critical priority for driving successful AI/ML adoption.

Conclusion:

As we stand on the threshold of a new era in finance, the prevalence of AI/ML in the industry is undeniable. With 76% of financial institutions already embracing or considering these technologies, the future promises unprecedented innovation and efficiency gains. By proactively addressing challenges, fostering a culture of compliance and learning, and investing in robust data strategies, institutions can harness the full potential of AI/ML to drive success in 2024 and beyond.

[/kc_column_text][/kc_column][/kc_row]