[kc_row _id=”566240″][kc_column _id=”282996″][kc_column_text _id=”393241″ css_custom=”{`kc-css`:{}}”]

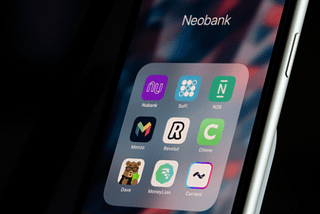

In the financial world, the rise of neobanks has been notable, especially in regions like Latin America. This phenomenon is clearly illustrated by the recent milestone achieved by Nubank, the Brazilian giant that has surpassed 90 million users, thus overtaking its European counterpart, Revolut. What drives this unprecedented growth of neobanks in LATAM? We will explore the reasons behind this remarkable success.

Financial Inclusion:

One of the key driving forces behind the success of neobanks in Latin America is the level of financial inclusion in the region. In contrast to Europe, where the majority of the population already had access to traditional banking services, in LATAM a large portion of the population was underbanked or completely excluded from the financial system. The arrival of neobanks offered an accessible and convenient alternative for those who previously lacked access to financial services, thus creating an untapped demand that neobanks were able to fulfill.

Technological Adoption:

The rapid growth of neobanks in LATAM has also been facilitated by the increasing technological adoption in the region. Despite Europe generally having a more advanced technological infrastructure, LATAM has experienced a significant increase in smartphone adoption and internet access in recent years. This technological penetration has allowed neobanks to reach a wide user base through mobile applications, thereby eliminating the need for costly physical infrastructure.

Regulations and Regulations:

Differences in regulatory environments between LATAM and Europe have also influenced the disparate growth of neobanks. While many Latin American countries have adopted more flexible and favorable regulations to encourage financial innovation and competition, in Europe neobanks face a more consolidated and strict regulatory framework. This regulatory disparity has allowed neobanks in LATAM to operate with greater flexibility and adapt quickly to market needs.

Consumer Preferences:

Consumer preferences and behaviors also play a crucial role in the adoption of digital financial services. In LATAM, there is a growing predisposition towards the adoption of new technologies, driven by a young demographic and low traditional banking penetration. This open-mindedness towards innovation contrasts with loyalty towards established banking institutions in Europe, enabling neobanks in LATAM to capture and retain a broader user base.

Conclusions:

The phenomenal success of neobanks in Latin America, exemplified by Nubank's rapid growth, is due to a unique combination of factors including the need for financial inclusion, technological adoption, favorable regulatory environment, and consumer preferences towards innovation. While neobanks are also gaining ground in Europe, they face additional challenges due to a more mature and saturated market. In summary, the rise of neobanks is transforming the global financial landscape, but their impact and adoption speed vary depending on regional differences in economic, social, and regulatory terms.

[/kc_column_text][kc_button text_title=”Read more” _id=”298577″ link=”https://www.linkedin.com/pulse/nubank-supera-los-90m-de-usuarios-y-parece-que-gana-la-conde-sayans-kcrif/?trackingId=JoySNSVUQQaoK%2BJdwG8E9g%3D%3D||_blank”][/kc_column][/kc_row]